A file photo of Treasury Cabinet Secretary John Mbadi.

By Daisy Okiring

NAIROBI, Kenya – May 7, 2025 — Treasury Cabinet Secretary John Mbadi has announced a proposal to cut Kenya’s Digital Service Tax (DST) rate from 3% to 1.5% as part of the Finance Bill 2025, a move aimed at reducing the tax burden on digital businesses and encouraging compliance.

Speaking during a Citizen TV interview on Tuesday, 6 May, 2025, Mbadi said the decision followed concerns from digital entrepreneurs—many of whom are small business operators—about the strain the current tax rate places on their operations. He emphasized that the adjustment would promote fairness and improve revenue collection.

If approved by Parliament, the revised DST will apply to income earned in Kenya through digital platforms or electronic networks. This tax, in effect since January 2021, targets companies offering services through online marketplaces and digital channels.

The Kenya Revenue Authority (KRA) clarified that DST payments are now due based on when services are rendered rather than when payments are made. Businesses must remit DST by the 20th of the month following the provision of services.

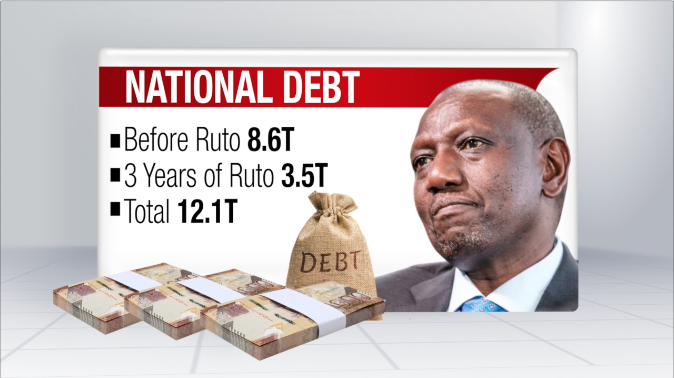

Read more: How Kenya is incurring Sh5 billion debt daily

The DST does not apply to non-resident providers of telecommunications or broadcasting services or licensed financial institutions registered under the Central Bank of Kenya.

In addition to DST reforms, Mbadi revealed that the Treasury is developing strategies to reduce other key taxes—including Value-Added Tax (VAT) and Pay-As-You-Earn (PAYE)—in a phased approach to enhance compliance and expand the tax base. He stressed that the goal is to make taxation less punitive while addressing Kenya’s fiscal deficit.

The Cabinet has already approved the Finance Bill 2025 and signaled austerity plans to revise the KSh 4.3 trillion budget before it reaches Parliament for debate.

3 thoughts on “Mbadi announces 50% cut in Digital Service Tax”

Comments are closed.