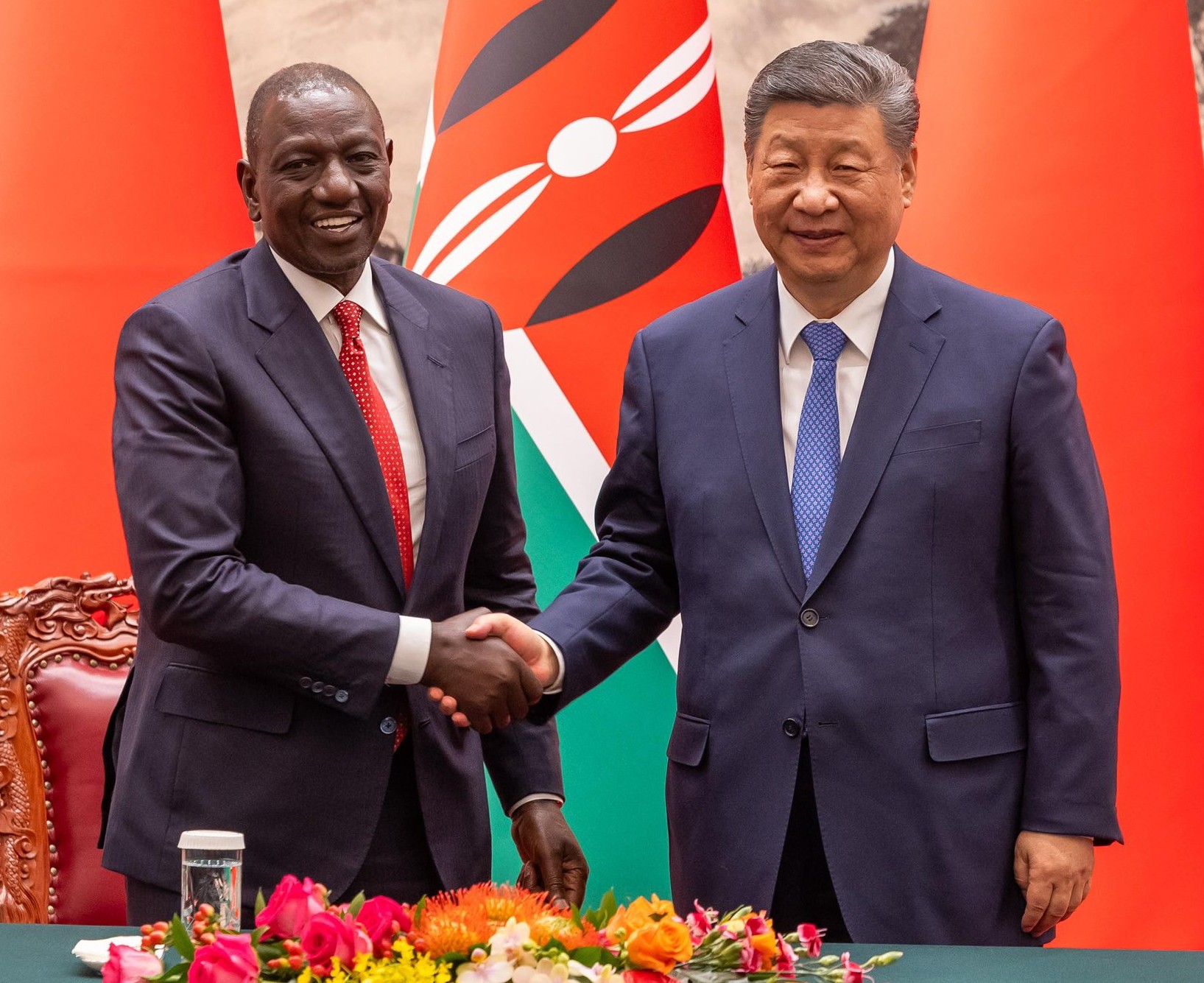

President William Ruto and Chinese President Xi Jinping. Photo/PCS

By Newsflash Reporter

Each passing day, Kenya’s debt continues to balloon by approximately Sh5 billion, adding immense pressure on the country’s already strained finances.

By the close of today, the national debt will have grown by another Sh5 billion, and by the time the sun rises tomorrow, an additional Sh5 billion will have been added.

In the current financial year, Kenya is set to spend over Sh1 trillion solely on debt servicing—covering both interest payments and loan principal repayments.

Projections by the National Treasury indicate that the cost of servicing public debt will climb by Sh294 billion, reaching Sh1.67 trillion in the next fiscal year.

For President William Ruto’s administration, this rising debt load is proving to be a major hurdle, limiting government capacity to deliver essential services without burdening taxpayers.

At the same time, the government is being forced to borrow even to fund recurrent expenditures like salaries.

Last Saturday, Treasury Cabinet Secretary John Mbadi admitted that Kenya has no choice but to continue borrowing to cover budget deficits between revenue and expenditures.

His remarks highlighted the tough balancing act facing President Ruto’s regime—managing swelling debt obligations while ensuring the provision of critical public services.

The current Sh5 billion-a-day repayment cycle stems from years of aggressive borrowing combined with budget deficits.

Kenya’s debt expanded rapidly between 2013 and 2022 under former President Uhuru Kenyatta’s administration, with most loans now maturing and demanding heavy repayments.

Kenya’s total public debt now stands at approximately Sh11.2 trillion, with debt servicing accounting for half of the Sh3.91 trillion 2024/2025 national budget.

Mounting pressure forces debt relief talks

Debt repayments have become such a heavy burden that Kenya has already approached institutions like the World Bank and the International Monetary Fund (IMF) for relief.

Although the government has started discussions with some lenders about restructuring the debt, progress has been slow.

Mbadi revealed that the country had aimed to finance the 2023/2024 budget without fresh borrowing, but prevailing economic realities made it unachievable.

Borrowing exceeded Sh891 billion—breaching the IMF’s ceiling set for Kenya under a Sh485 billion support programme.

Read more:Ruto blows hot and cold on Kenya, US &China relations

In fact, during the last financial year ending June 2023, Kenya borrowed Sh865 billion, overshooting IMF targets by Sh26 billion according to the Auditor-General’s findings.

This growing debt load restricts President Ruto’s ability to fulfill campaign promises, even as pressure mounts from a restless public grappling with high living costs and unemployment.

Recent data shows that between July and December 2024, Kenya spent Sh541 billion on debt service—surpassing what it spent on development initiatives.

Shifting focus to revenue growth and investment

Treasury officials have indicated a new strategy that focuses on growing revenue through taxation and attracting foreign investments instead of relying heavily on borrowing.

They stressed the importance of supporting small and medium-sized enterprises to boost economic growth and widen the tax base.

However, new tax measures introduced under the Finance Act 2023 and the Finance Bill 2024 have attracted criticism, with many citizens arguing that they have worsened the cost of living crisis.

Mbadi noted that Kenya has successfully refinanced a $2 billion Eurobond due in June 2025 and is now negotiating the restructuring of a $1.5 billion Eurobond set to mature in 2027.

As of December 2024, Kenya’s debt-to-GDP ratio stood at 65.6 percent, significantly higher than the IMF’s recommended threshold of 50 percent for developing nations.

Read more:Tycoon Peter Munga to lose Sh510 million to auctioneers

Appearing before Parliament’s Public Debt and Privatisation Committee last year, former Treasury Cabinet Secretary Njuguna Ndung’u confirmed that Kenya was facing debt distress and had initiated talks with creditors including China’s Exim Bank, the World Bank, and the IMF.

Despite these efforts, not all renegotiation attempts have borne fruit.

Kenya remains under IMF pressure to steadily reduce its fiscal deficit from 5.7 percent of GDP in 2024 to 3.5 percent by 2027 under the ongoing Sh485 billion programme.

2 thoughts on “How Kenya is incurring Sh5 billion debt daily”

Comments are closed.