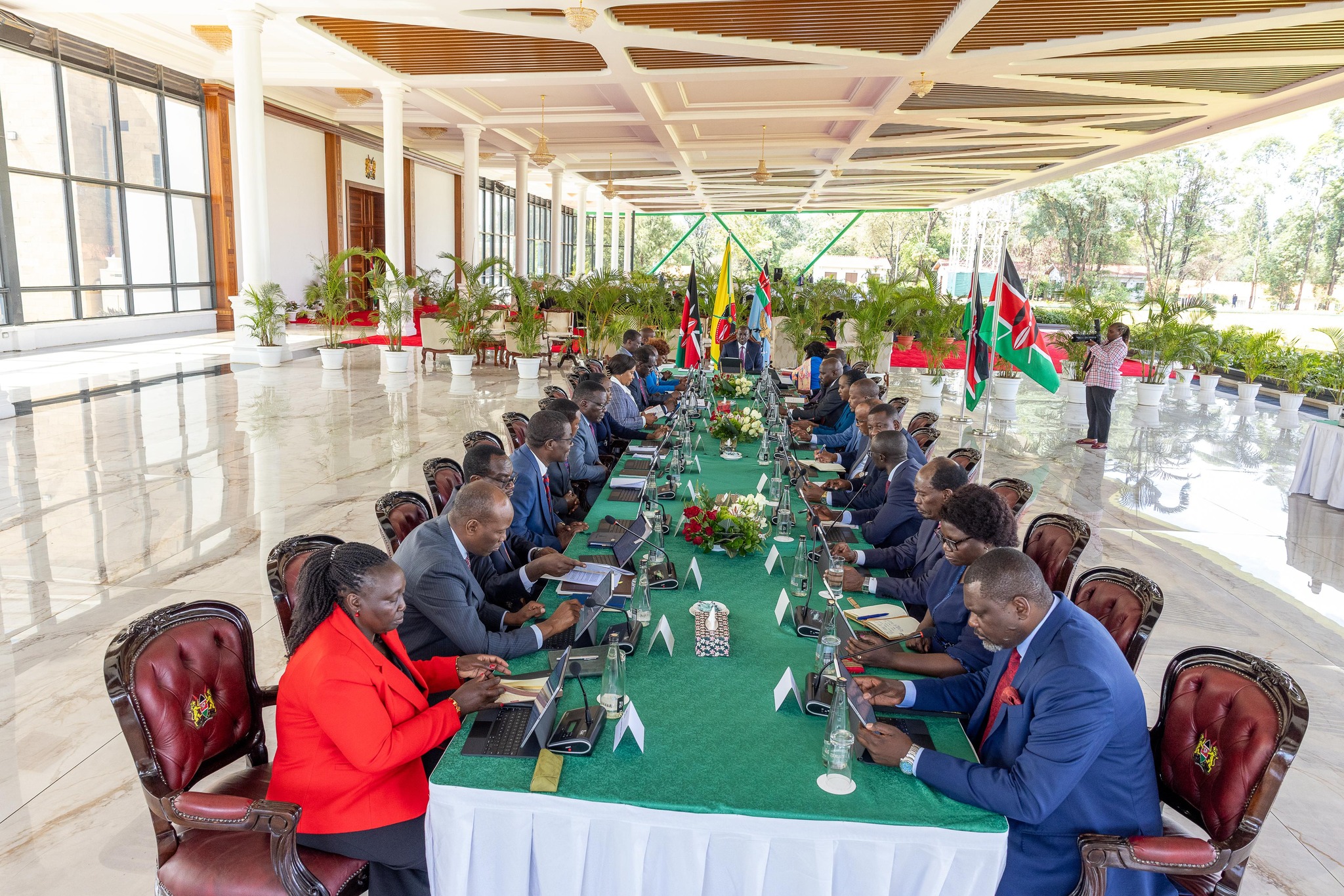

President William Ruto chairs a Cabinet meeting on 29 April, 2025 at State House, Nairobi. Photo/PCS

By Newsflash Writer

NAIROBI, April 29, 2025 — The Cabinet on Tuesday approved the Finance Bill 2025, signaling a shift from aggressive tax-raising measures to a strategy focused on enhancing tax administration and closing long-exploited legal loopholes.

In a meeting chaired by President William Ruto at State House, Nairobi, the Cabinet also approved a series of legislative reforms aimed at improving public finance, judicial welfare, healthcare access, and investment attractiveness.

The Finance Bill 2025, expected to be tabled in Parliament soon, comes in the wake of last year’s controversial Finance Act 2024 that triggered nationwide protests. On June 25, 2024, more than 30 protesters were killed in clashes with police, sparking public outrage and condemnation from civil society and international bodies. In response, the government promised a more consultative and reform-based approach to taxation and spending.

This year’s Bill reflects that promise. It targets loopholes in tax expenditures that have enabled inflated refund claims and revenue leakage. Instead of introducing new taxes, it focuses on amendments to existing tax laws — including the Income Tax Act, VAT Act, Excise Duty Act, and Tax Procedures Act — to improve revenue collection and reduce disputes.

Read more: Governors threaten shutdown over Sh38 billion budget cut

Among the key changes is the overhaul of the tax refund process, which has long been marred by delays and abuse. The Bill proposes faster, stricter processes and safeguards against fraudulent claims. Small businesses stand to gain as well, with provisions allowing them to fully deduct the cost of tools and equipment in the year of purchase — a move that boosts liquidity and supports growth.

Support for retirees and workers

The Bill also delivers relief for retirees by making all gratuity payments — whether public or private — fully tax-exempt. This provision ensures that senior citizens receive their full benefits without deductions, reinforcing retirement dignity.

In a further pro-worker move, employers will now be required to apply all eligible tax reliefs automatically when calculating PAYE taxes. This change will eliminate the current burden on employees to claim refunds from the Kenya Revenue Authority due to employer oversight.

Strengthening county and judicial systems

The Cabinet also approved the Public Finance Management (Amendment) Bill, 2024, which mandates all counties to establish County Emergency Funds. This decision follows lessons from the 2023 El Niño floods, where inadequate preparedness hampered disaster response. The amendment seeks to ensure counties are financially equipped for future emergencies, in line with a directive issued during the 24th Intergovernmental Budget and Economic Council (IBEC) session in August 2024.

Another major decision was the endorsement of the Judges Retirement Benefits Bill, 2025. The Bill introduces a standalone pension system for superior court judges, distinct from the general Pensions Act. It provides a Defined Benefit plan for current judges and a Defined Contribution scheme for future appointees. The new system includes pensions, gratuities, medical coverage, and diplomatic privileges for retired judges and their spouses, reinforcing judicial independence and public service integrity.

Healthcare, investment and environmental reforms

In support of Universal Health Coverage (UHC), the Cabinet approved the construction of two Level VI teaching and referral hospitals in Bungoma and Kericho, in partnership with the African Development Bank. These facilities aim to improve healthcare access in underserved regions and strengthen medical training.

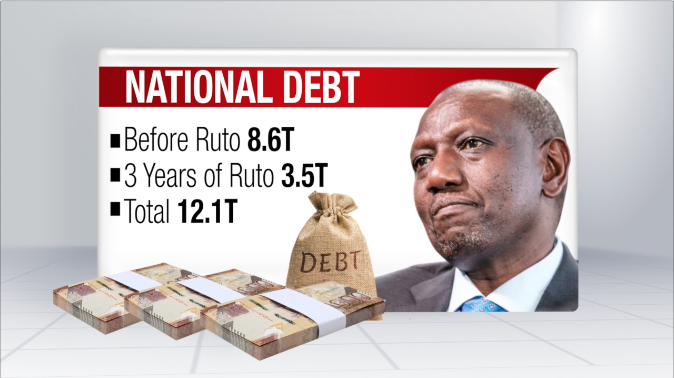

Read more:How Kenya is incurring Sh5 billion debt daily

To attract investment, the Cabinet approved amendments to the Capital Markets Act, removing shareholder limits in regulated institutions. However, the Cabinet Secretary will retain the authority to impose limits on specific license categories if needed. These changes are designed to deepen Kenya’s financial markets without affecting government revenue.

On the environmental and agricultural front, the Cabinet backed the Draft Pest Control Products Bill, 2024, which creates a new Pest Control Products Authority. The Bill aims to enhance regulation, food safety, environmental protection, and compliance with global standards.

In a bid to further tighten fiscal discipline, President Ruto directed all Cabinet Secretaries to work with the National Treasury to identify budget adjustments within their ministries and departments. The government has set a target to reduce the fiscal deficit to 4.5% of GDP for the 2025/26 financial year — down from 5.3% in 2023/24 — with a long-term goal of reaching 2.7%.

With the Finance Bill 2025 and accompanying reforms, the government hopes to restore public confidence, enhance service delivery, and promote economic growth while steering away from the tensions that marred last year’s fiscal policies.

2 thoughts on “Cabinet approves Finance Bill 2025; avoids raising taxes”

Comments are closed.