Treasury Cabinet Secretary John Mbadi. Photo/Handout

By Newsflash Reporter

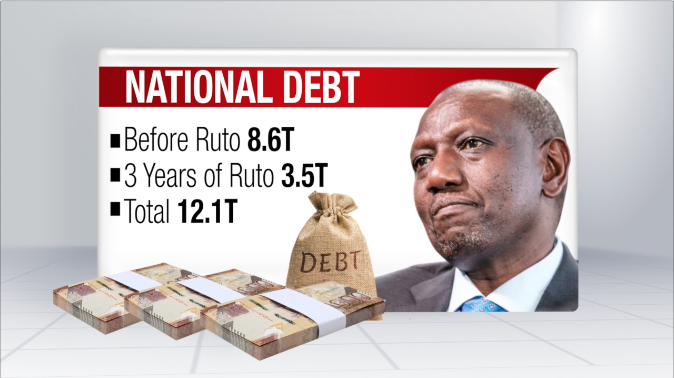

A Central Bank of Kenya (CBK) report presented to Parliament reveals that President William Ruto’s Kenya Kwanza administration has accumulated at least Sh3 trillion in new debt over its three years in office, further straining the national debt burden.

According to the brief submitted to the Public Debt and Privatisation Committee by CBK Governor Dr Kamau Thugge, the country’s total public debt stood at Sh8.7 trillion in the 2021/22 financial year—the year President Ruto assumed office.

Debt grows as domestic borrowing rises

The CBK figures indicate that by June 30, 2025, the public debt had surged to Sh11.81 trillion, representing a 17 per cent increase, with heavier dependence on domestic borrowing. This trend underscores mounting debt service pressures that continue to challenge fiscal sustainability. “Recent borrowing targets have been quite ambitious as the domestic market continues to support growing budgetary financing requirements,” the CBK report submitted to the committee led by Balambala MP Abdi Shurie states.

Read more: How Kenya is incurring Sh5 billion debt daily

The data translates to an average borrowing of Sh1 trillion per financial year under the Kenya Kwanza administration. However, the report does not specify which projects were funded using the Sh3 trillion acquired in the administration’s first three years.

The current debt portfolio is composed of Sh6.33 trillion in domestic loans and Sh5.5 trillion in external borrowing. President Ruto, sworn in on September 13, 2022 after the August 9 general election, pledged to implement fiscal consolidation measures to restore debt stability in an economy weakened by drought, floods, and the Covid-19 pandemic. In 2020/21, the national debt stood at Sh7.7 trillion before rising by Sh1.1 trillion in the 2021/22 financial year.

Interest burden exposes economic strain

In the 2020/21 fiscal cycle, foreign debt made up a larger share, estimated at Sh3.999 trillion compared to Sh3.7 trillion in domestic liabilities. The fiscal discipline President Ruto promised was expected to curb excessive borrowing and reduce the debt-to-GDP ratio, which currently stands at 69 per cent, according to CBK data. In October 2023, Parliament amended the Public Finance Management (PFM) Act, replacing the Sh10 trillion debt ceiling with a 55 per cent debt-to-GDP threshold in Net Present Value (NPV) terms.

However, rising interest costs on domestic borrowing reflect Kenya’s deepening reliance on the local market, crowding out Small and Medium-sized Enterprises (SMEs) from accessing affordable loans.

Read more:Gachagua Pledges to scrap housing levy, focus on debt recovery

For instance, domestic interest payments were Sh388.8 billion in 2020/21, rising to Sh456.8 billion in 2021/22, Sh533.1 billion in 2022/23, and Sh622.5 billion in 2023/24 before climbing to Sh776.3 billion in the 2024/25 financial year. Although Dr Thugge maintains that the public debt remains within manageable limits, he concedes that Kenya faces “a high risk of debt distress.”

This signals that the government may struggle to meet repayment obligations in the future, especially amid falling revenue collections linked partly to unpopular policies. Domestic interest costs jumped by 24.7 per cent to Sh776.3 billion in 2024/25, up from Sh622.5 billion the previous year, driven largely by increased obligations on Treasury bonds and shifts in domestic debt composition.