By Daisy Okiring

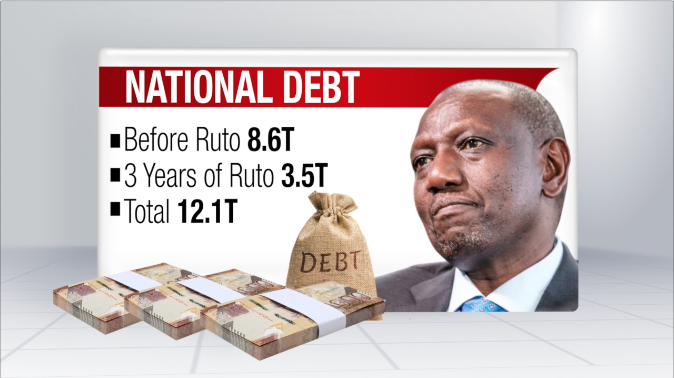

NAIROBI, Kenya– Kenya’s appetite for loans continues to soar, with new Treasury data showing the government borrowed Sh95.5 billion between May and August 2025 — equivalent to Sh32.4 million every hour. The borrowing has now pushed the country’s total public debt to a record Sh12 trillion, raising renewed fears about fiscal sustainability.

Treasury data reveals alarming borrowing pace

The National Treasury’s latest report, tabled in Parliament on October 7, 2025, breaks down the borrowing into Sh23.9 billion per month, Sh776.6 million per day, and nearly Sh9,000 per second. Treasury Cabinet Secretary John Mbadi said the new loans were sourced from bilateral, multilateral, and commercial lenders to fund critical projects and bridge budget shortfalls.

“Some of these facilities were recorded after the reporting period but are reflected in the Commonwealth Meridian system,” the report noted, citing a mix of dollar- and euro-denominated loans with interest rates ranging from 1.41 to 8.25 per cent and commitment fees of 0.25 per cent.

Under Section 31(3) of the Public Finance Management Act, the Treasury is required to update Parliament every four months on new foreign-denominated loans, detailing repayment terms, interest, charges, and benefits.

Read More: DStv loses 80 percent of its Kenyan subscribers in one year

Billions borrowed to fund key projects

Of the total borrowed, Sh62 billion came from an international sovereign bond issued on April 30, 2025, by CitiGroup Global Markets Europe AG. The bond, carrying an annual interest rate of 8.25 per cent, is due for repayment in two tranches of $250 million each in 2030 and 2032. Treasury officials said the funds would be used for liability management and budgetary support for the 2025/26 financial year.

Another Sh16.4 billion was secured from the International Fund for Agricultural Development (IFAD) to finance the Integrated Natural Resources Management Programme, which aims to enhance climate resilience and improve livelihoods for women, youth, and vulnerable communities. The loan will be repaid over 40 semi-annual instalments between 2030 and 2049, at an interest rate of 1.41 per cent.

The Organisation of Petroleum Exporting Countries (OPEC) also extended a Sh9.17 billion loan to support the Economic Inclusion and Green Recovery Support Programme, designed to promote budget transparency, strengthen debt management, and improve public spending efficiency.

Mounting debt and economic strain

Kenya’s debt is now equivalent to about 62 per cent of the country’s Gross Domestic Product (GDP), far above the 55 per cent ceiling set under the 2023 Public Finance Management (Amendment) Act. Economists warn that the ballooning debt could undermine long-term growth and strain essential public services.

For the 2025/26 fiscal year, the Treasury projects debt servicing costs to hit Sh1.098 trillion — including Sh646.4 billion in principal repayments and Sh196.7 billion in interest. The government attributes the heavy borrowing to revenue shortfalls and widening fiscal deficits, worsened by global economic pressures.

Opposition leaders and economists are now urging the government to tighten spending and review its borrowing strategy. “We risk dire economic consequences if the current trend continues unchecked,” Kiharu MP Ndindi Nyoro said, calling for stronger fiscal discipline and prioritization of domestic revenue generation.

Read More: Kenya’s tourism sector hits record Ksh.452 billion in 2024 – CS Miano

Calls for fiscal reforms and debt transparency

Policy analysts have criticized the government for its overreliance on external borrowing, noting that many loan-funded projects yield low returns. They argue that transparency and accountability in debt management remain weak, making it difficult for citizens to track how funds are used.

Treasury officials, however, maintain that the new borrowing strategy aims to reduce reliance on short-term, high-interest loans and replace them with concessional financing. The Ministry has also promised to publish detailed loan data to enhance public scrutiny.

As debt obligations mount, experts caution that Kenya could face tougher repayment conditions in future markets, especially if credit ratings decline. With 2027 elections drawing closer, fiscal reforms and economic discipline will remain under the spotlight — testing whether the government can steer the economy back to a sustainable path.