A train on Kenya’s Standard Gauge Railway (SGR). Photo/Handout

By Newsflash Correspondent

Kenya is negotiating with China to slash the interest rate on its multi-billion-shilling Standard Gauge Railway (SGR) loan from 6.37 percent to about three percent.

The deal involves converting the dollar-denominated debt into yuan, a move expected to ease the country’s mounting debt servicing costs.

The ongoing talks, which are reportedly at an advanced stage, are projected to significantly reduce Kenya’s annual debt repayments to China, currently standing at about Sh130 billion. Treasury Cabinet Secretary John Mbadi confirmed the government’s strategy is to diversify the currency mix of foreign debt in a bid to lower costs.

“When the loan is in US dollars, it is SOFR plus a markup, but a renminbi comes at a fixed rate, nearly half the cost. So there are major savings,” Mr Mbadi said.

Shifting from Dollar to Yuan

Under current terms, the SGR loans—over Sh500 billion borrowed mainly from the Export-Import Bank of China—attract interest at SOFR, which is about 4.6 percent, plus an additional two percent. Switching to yuan would lock in a fixed rate at around three percent.

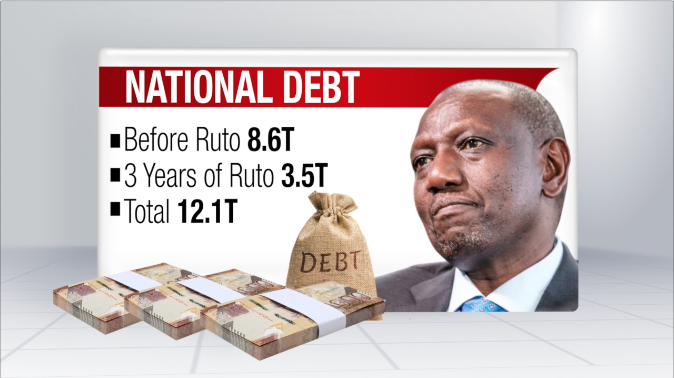

Kenya, which the International Monetary Fund (IMF) classifies as being at high risk of debt distress, has faced growing pressure to rework its public finances since 2024.

Read more: Why Kenya has rejected Sh468bn Nairobi–Mombasa Expressway

That year, widespread anti-government protests forced President William Ruto to withdraw the controversial Finance Bill, which had proposed Sh345 billion in new taxes.

The SGR loans were originally taken under President Uhuru Kenyatta’s administration and were tied to floating interest rates set above the now-defunct London Interbank Offered Rate (Libor). Following Libor’s retirement in 2023, SOFR became the new global benchmark, pushing Kenya’s repayment costs even higher.

Heavy burden on taxpayers

Economists say the switch to yuan is likely part of a broader strategy to replace expensive commercial debt with concessional terms, potentially extending repayment periods in the future. “The government wants to move from variable to fixed interest rate payments, which explains its confidence that costs will halve under yuan,” said Churchill Ogutu, an economist at IC Group.

Debt repayments to China, particularly for the SGR, remain one of the heaviest burdens on Kenya’s taxpayers. In the financial year ending June 2026, Treasury has budgeted Sh129.90 billion for Chinese loans—Sh95.64 billion in principal and Sh34.26 billion in interest. A large share of this is owed to China’s Exim Bank, which financed nearly 90 percent of the initial $3.75 billion (about Sh485 billion) cost of the 700-kilometre railway from Mombasa to Suswa.

Read more: Kenya eyes China bond to fund SGR

Despite the massive investment, the SGR has struggled to meet revenue targets. Importers have resisted the costly tariffs for freight transport from Mombasa to Nairobi and Suswa, undermining the project’s economic justification. Plans to extend the line to the Ugandan border at Malaba stalled after Beijing demanded a financing commitment from Kampala.

“The repayment burden is heavy, but the bigger concern has always been the inflated construction costs and the project’s consistent failure to generate revenue,” Fergus Kell, a research fellow at Chatham House, observed. He argued that political interests, rather than strategic planning, drove the project, with Chinese loans fueling Kenya’s wider borrowing spree during Kenyatta’s presidency.

The Ruto administration, meanwhile, is pushing to revive talks with Beijing to extend the railway to Uganda, in hopes of unlocking regional freight demand. Whether the yuan swap will ease Kenya’s debt pain—or merely delay it—remains to be seen.