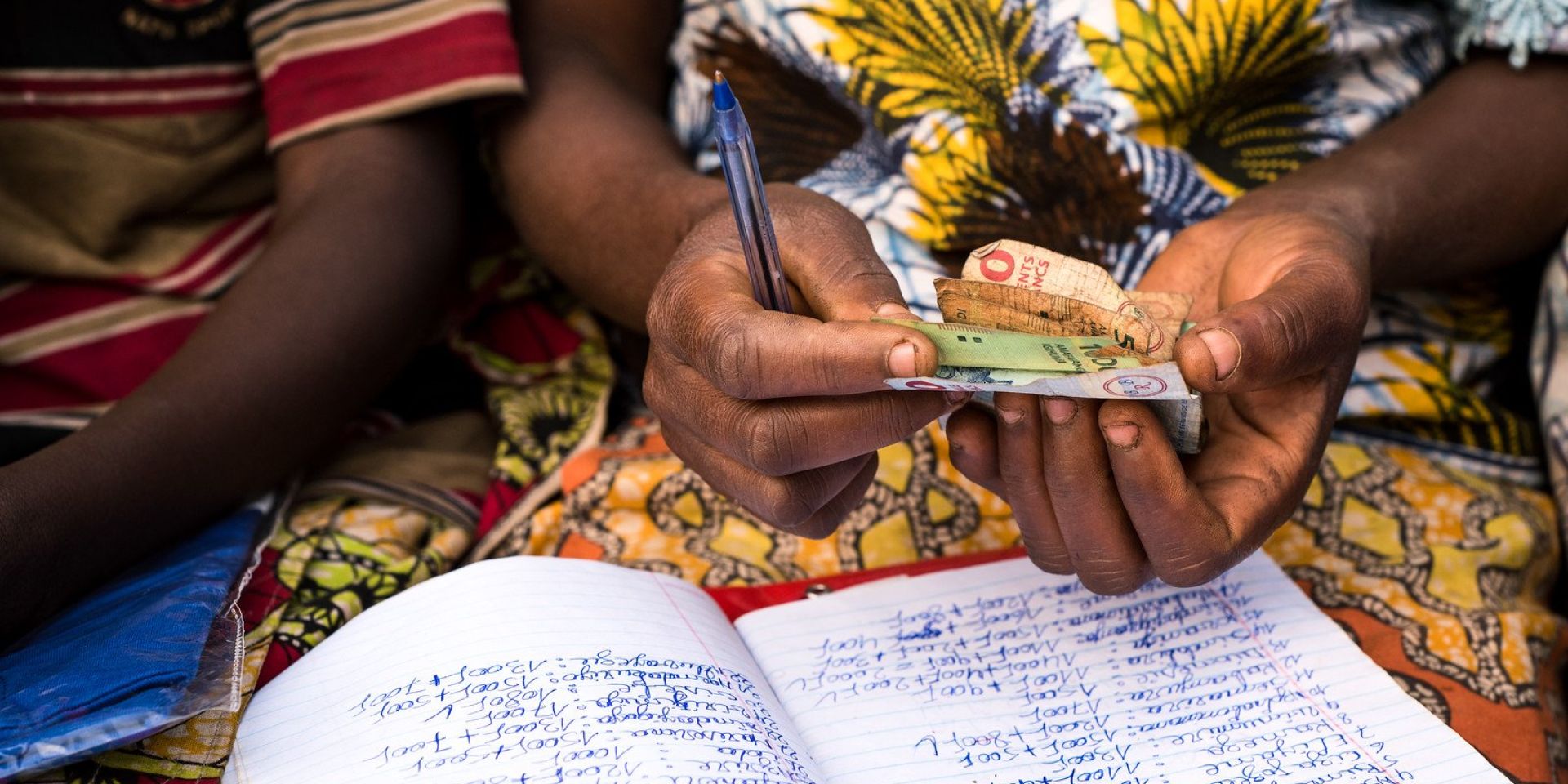

Kenya woman trying to balance expense with less hard earned money. Photo/Courtesy

By Daisy Okiring

A new survey by Trends and Insights for Africa (TIFA) has revealed a sharp decline in the number of Kenyans who say they are financially secure, underscoring the mounting strain on households amid high taxation, soaring food prices, and stagnant incomes.

According to the findings, only 7% of Kenyans now feel they are financially stable, compared to 25% a year ago. The dramatic fall signals that more households that were previously able to cope have now slid into hardship, joining the growing majority that report serious difficulty meeting their basic needs.

The study provides statistical backing to what many Kenyans have been voicing for months: that the economy is biting harder and daily survival has become increasingly difficult.

Rising costs and shrinking paychecks

TIFA’s findings mirror the lived realities across towns and villages where food, fuel, and electricity prices continue to climb, often outpacing incomes. Families that once considered themselves “just managing” now report having to cut meals, delay paying rent, or depend on credit and loans to get through the month.

The collapse from 25% to 7% in those who feel financially secure highlights the pace at which Kenyans are being squeezed. “We are no longer talking about poverty as something affecting only the most vulnerable,” said one economist who reviewed the findings. “This is now a middle-class crisis, with professionals, small traders, and salaried workers all saying they cannot make ends meet.”

Read More: Eyes on Tharaka Nithi: Is Ruto fulfilling his promises?

Policy backlash: Finance Act 2025 under fire

The survey comes against the backdrop of widespread criticism of recent government policies, particularly the Finance Act 2025, which introduced new taxes on essentials, widened VAT coverage, and increased levies on salaries.

While the government has defended the measures as necessary for revenue collection and debt servicing, Kenyans argue that the policies have drained already limited disposable incomes.

Street interviews conducted in Nairobi’s Eastleigh and Mombasa’s Kongowea market reflect the mood: “We are paying taxes on everything, but our pockets are empty. Even small businesses can’t survive,” lamented a trader.

Kenya Kwanza’s bottom-up model faces pressure

The findings land at a sensitive time as President William Ruto’s Kenya Kwanza administration marks its third year in office. Since its election, the government has consistently promoted the bottom-up economic model, promising to empower hustlers, boost small-scale businesses, and create jobs.

Officials argue that the reforms currently underway—ranging from tax realignment to new credit facilities for SMEs—are long-term measures designed to strengthen the economy and reduce living costs.

However, the TIFA survey suggests that for ordinary Kenyans, the promised relief remains elusive. Instead, public perception is that life has become harder than before.

A widening trust gap

The survey also exposes a growing trust gap between government assurances and public sentiment. While Treasury officials insist inflation is stabilizing and growth forecasts remain positive, ordinary citizens tell a different story.

“When you hear government say things are improving, and then you go to the supermarket and everything has doubled in price, you know something is wrong,” said a civil servant in Kisumu.

The gap is further widened by rising unemployment, especially among youth, and limited wage growth in both public and private sectors. Many Kenyans who had stable jobs are now struggling with debt, while casual laborers face reduced opportunities.

Read More: The hunger paradox: Why africa feeds the world but can’t feed itself

Political implications ahead of 2027

The economic strain documented by TIFA could have significant political implications as the country inches closer to the 2027 General Election. Already, opposition leaders have seized on the survey to criticize the Kenya Kwanza administration’s economic record, accusing it of burdening citizens while failing to deliver tangible relief.

Civil society groups have also begun calling for a review of the Finance Act, urging government to prioritize job creation, affordable credit, and food security instead of heavy taxation.

“The numbers show people are hurting. This is not about politics but survival,” noted a policy analyst.

Searching for solutions

Economists warn that unless urgent interventions are introduced, the situation could worsen, with more households sliding into vulnerability. Some of the recommended measures include reducing the tax burden on essentials, expanding social safety nets, improving agricultural productivity to stabilize food prices, and tackling corruption that drains public resources.

Meanwhile, the government maintains that patience is required. “Our economic transformation is a journey, not an event,” one Cabinet Secretary recently stated. “These reforms will bear fruit in time.”

For many Kenyans, however, patience is running thin. With only 7% now feeling financially secure, the survey highlights a stark reality: a nation struggling under the weight of economic headwinds, waiting for relief that has yet to arrive.