Genz Preotests finance act as excessive borrowing has pushed Kenya to the brink of a debt crisis. Photo/Courtesy

By Daisy Okiring

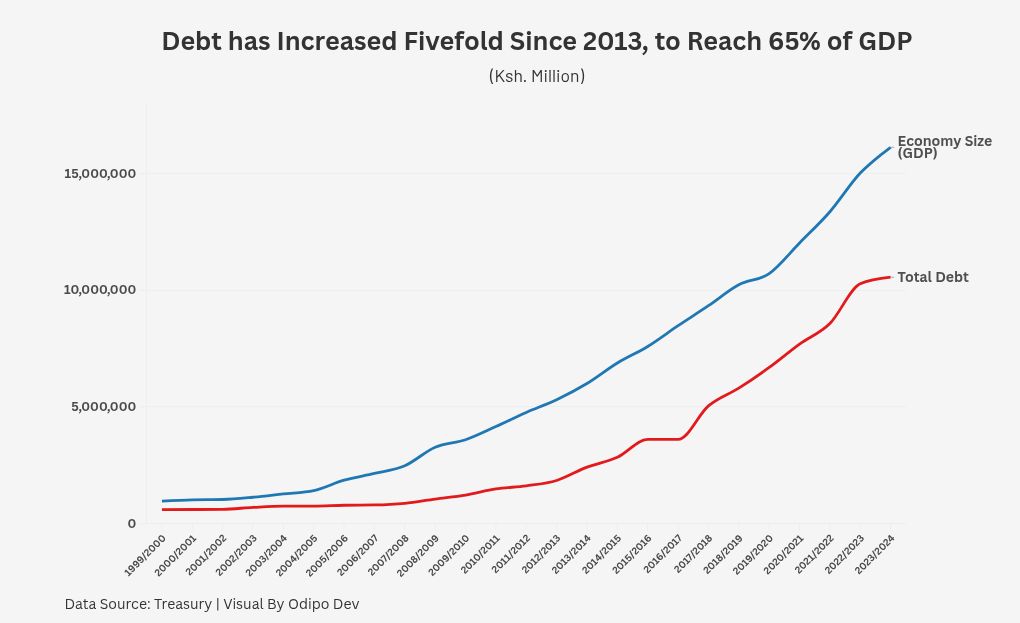

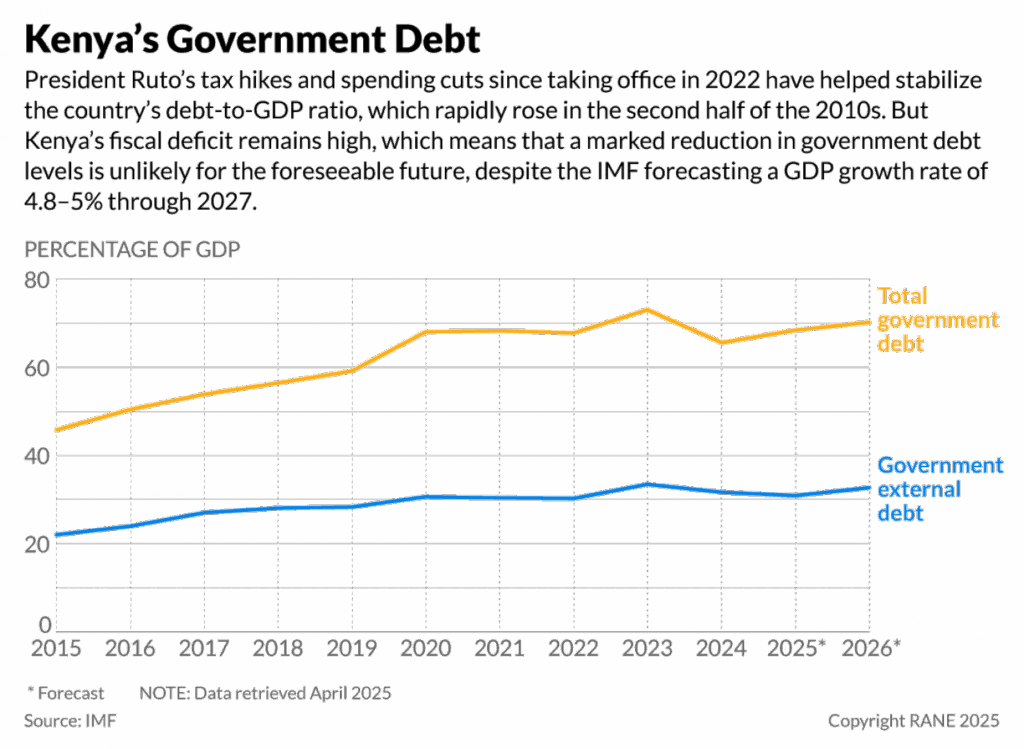

NAIROBI– Kenya is sinking deeper into a debt trap, with a new report revealing that Ksh7 of every Ksh10 collected in revenue now goes toward debt repayment. The Okoa Uchumi public debt report, released on Tuesday, warns that the country’s current economic trajectory is unsustainable and calls for urgent reforms to avoid a total fiscal collapse.

According to the findings, Kenya’s total debt has reached Ksh11.81 trillion, with domestic borrowing standing at Ksh6.3 trillion and external loans at Ksh5.48 trillion. This marks a sharp rise in local borrowing, which the report says is increasingly benefiting the wealthy while burdening the poor through higher taxes and inflation.

“Kenya is already in a debt crisis. Domestic debt has overtaken foreign debt and is more prone to misuse. With external debt, we can track the funds, but for domestic debt, we cannot,” said Alexander Riithi, Head of Programs at The Institute for Social Accountability (TISA).

Debt eating into national budget and public services

The report shows that debt repayments now consume about 70 percent of all government revenue, leaving only 30 percent for other essential functions, including education, health, and infrastructure. This, according to analysts, has created a dangerous imbalance that leaves Kenya vulnerable to economic shocks and corruption.

“Half of the country’s income is being used to pay old loans, while schools, hospitals, and counties remain underfunded,” Riithi said.

He added that unchecked borrowing and weak accountability structures have worsened the situation. Unlike foreign loans that are subject to international oversight, domestic debt lacks transparency and often benefits politically connected lenders.

The report also highlighted the social toll of Kenya’s growing debt burden, noting that unemployment remains at about 30 percent while essential services deteriorate.

“We have an education system that hasn’t been tested, and the health sector has become a killing field where corruption decides who survives,” Riithi said grimly.

Read More: Has President Ruto truly transformed Kenya’s agriculture three years on?

Civil society demands radical fiscal reforms

Human rights and governance organizations under the Okoa Uchumi coalition are now calling for bold fiscal reforms to restore public confidence and economic stability.

Among their key recommendations are banning new loans from the World Bank and IMF, scrapping or reforming the National Government Constituencies Development Fund (NG-CDF), stopping unapproved supplementary budgets, and ensuring full public disclosure of all loans, amounts, and creditors.

“We need to get off the yoke of the World Bank and IMF. These institutions were created to rebuild Europe after the world war. How does that plan help Africa’s development?” asked Saboti MP Caleb Amisi during the report’s release.

Read More: World Bank raises Sub-Saharan Africa growth forecast to 3.8% for 2025

TISA Executive Director Diana Gichengo echoed the same concerns, saying supplementary budgets have become tools for unchecked spending and political manipulation.

“We urge the government to completely do away with supplementary budgets. Each one increases the fiscal gap with expenditures that were never approved,” Gichengo said. “NG-CDF must also be reformed to ensure transparency and accountability.”

Kenya at a crossroads

The report warns that without immediate corrective measures, Kenya risks plunging into a permanent debt crisis. It emphasizes that the country’s reliance on domestic borrowing, coupled with poor fiscal discipline, will continue to drain resources away from essential development and social programs.

Economists have also cautioned that the heavy debt load limits Kenya’s ability to invest in infrastructure, job creation, and social welfare. The burden of repayment, they say, is ultimately borne by ordinary citizens through higher taxes and a rising cost of living.

“The government must now prioritize fiscal responsibility over political spending. Every shilling borrowed must be justified, disclosed, and monitored,” the report concludes.

As Kenya faces mounting pressure from lenders and the public, the Okoa Uchumi coalition insists that transparency, accountability, and structural reform remain the only viable path toward restoring the country’s economic sovereignty.